UPI (Unified Payment Interface)

UPI or Unified Payment Interface is a real time payment system developed to facilitate seamless inter Bank transactions by using uniquely generated UPI ID without the hassle of typing your card details, or net banking/wallet password. To be able to Send and Receive money using UPI, both parties need to have a UPI Client installed which comes in the form of various apps such as BHIM, PhonePe, Google Pay to name a few.

One can either Send / Receive Money using UPI ID and Pin. Sending money requires you to enter a PIN while receiving money does not. For receiving payment via UPI you just need to provide your UPI ID to the Sender.

To receive money, the receiver just needs to share his VPA (UPI ID) with Sender. Receiving money does not require you to enter PIN.

Fake Customer Care Numbers

Nowadays, Scammers have started posting Fake Customer Numbers in the review Section of businesses. Generally for those Businesses which do not answer Support Calls after working time. Scammers get an advantage of this and post their own numbers as Customer Care Number.

When people try to contact an official number given on the site, in most of the scenarios it happens to be a Landline number. Due to this it does not get answered after the office time. As customers want to resolve their Issues quickly, they tend to search for alternate numbers and land themselves into fake customer care numbers.

After calling such numbers, the fake representatives often ask for account details and OTP for said verification purposes, people submit the information and end up losing the money.

PhonePe Cashback Scam

PhonePe is one of the popular UPI Applications that enables sending and receiving money from and to any bank account seamlessly with just an UPI ID.

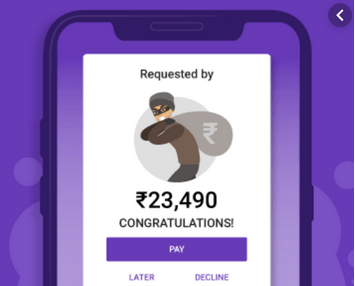

Nowadays Scammers are using a new tactic to fraudulently get the money via UPI using Social engineering.

Here’s how the scam happens:

- Scammers contact victims and pretend they are calling from the PhonePe Customer Service.

- They say that they are contacting because the victim has some unclaimed cashback received in his PhonePe wallet received from the previous transactions.

- They send a Money Request to the victim once he confirms that he is using PhonePe. Further the scammers say that in order to avail the cashback in the Bank account, the victim needs to accept.

- As Receiving money does not need user to enter his UPI PIN, people get suspicious and question the scammer about the same.

- Scammer then convinces the victim that the cashback received is in the wallet and in order to transfer it to the Bank account, the PIN has to be entered.

- When victims complain about the debited money, the scammer assures them that it will get credited in 48 hours or make some excuses to make victims pay again.

- In reality, upon accepting the request and entering the UPI PIN, money is debited from the Victim’s account and transferred into Scammer’s account.

How to keep yourself Safe ?

- PhonePe or any other application never calls their users directly and asks for the sensitive information. One shall never respond to such calls and immediately report the incident to the concerned authorities as well as block the number.

- In most cases, scammers obtain your contact information from the social media sites where privacy settings are set to Public. That needs to be changed to prevent other scammers from accessing your details.

- It is always important to keep in mind that we shall never share information such as OTP, UPI PIN or make payment to another person whom we do not know or trust.

- When using any UPI App, one must always remember that we do need to enter the UPI PIN when receiving the money, it is needed only when sending it to someone else’s bank account or UPI ID.

Read More about UPI Related Frauds : https://cyberforensics.miniorange.com/upi-fraud/