OTP Fraud

If you are a frequent consumer of Online Purchases, then you might be familiar with the term OTP or One Time Password. OTP is an added factor of authentication and is enabled by a Bank for verifying whether the transaction is initiated by the user or not.

When making any online transaction, user receives a 6 to 8 character long One Time Password on his email address or mobile number registered with the bank, transaction succeeds only after entering the correct OTP.

Why you shouldn’t share OTP with others

Your name, mobile number, email id and date-of-birth are like a unique identity for you. You can use it to register yourself for online services like banking apps, social messaging platforms, social media sites. But these are common details, which are publicly available so couldn’t be used to verify and validate you. But one doesn’t have access to your personal device (mobile) or email account.

Here OTP comes into the picture. By entering OTP you get access to your account. OTP is also used for online transactions, when you enter the OTP then the transaction is completed.

What if you share OTP on call

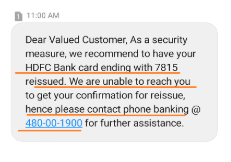

If someone wants to get into your account, he will require the OTP sent to your phone. To get that OTP, he might make a fraudulent call pretending to be an authorized party and would ask you for the OTP. and once you share the OTP, he would get access to your account. To gain your trust, he might mention that he is from a bank or from a trusted third party.

Using an OTP a person can create an account by pretending to be you. That account can be used for the wrong purposes. Or use it to access your account and use it against you. One can make an online transaction and purchase a product, transfer money.

Preventive Measures for OTP Fraud

- To not become a victim of OTP fraud, you must not share your OTPs over the phone. Banks or any service provider never ask for your passwords or OTPs.

- App pin, UPI pin, CVV number, expiry date of debit card and 16 digit debit card number is for personal use. These should never be shared with anyone in any circumstances.

- Never reveal your account related information on Social Media.

Solutions if you are a victim of OTP Fraud

If you are a victim of OTP fraud and want to catch the scammer, you can reach out to us.