Income Tax Fraud

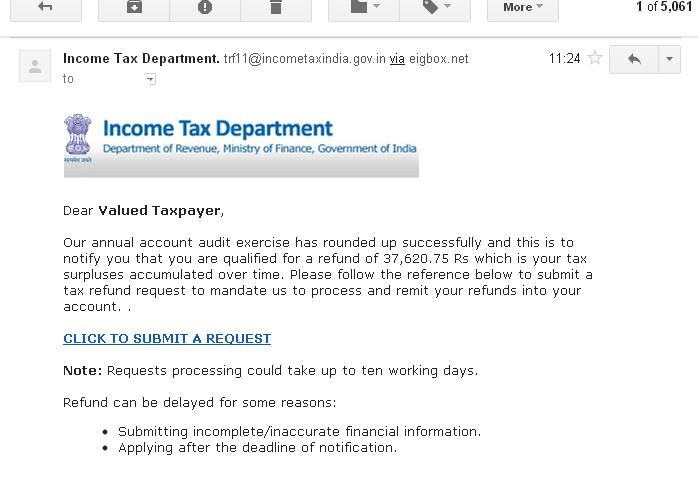

Once taxpayers are done filing their IT Returns, after a few days or so , they start to receive an email / SMS saying that they are entitled to some amount of money as a refund.

The name and the images resemble the Income Tax department. The mail / SMS includes a link to the website where you need to enter information and request for Refund. If you click on the link, It loads a webpage that looks like the Income Tax Website and you might think that the stuff there is genuine.

The website asks for Account related Information such as Credit / Debit card details including Number , CVV, Expiry Date and PIN.

Here’s what a phishing mail looks like. Click here for more examples of Phishing emails.

Preventive Measures for Income Tax Fraud

- Always look at the sender’s address, phishing emails have sender email address that resembles genuine entity ex. incometaxefiling@gov.in, and are often spoofed. notice the missing l from filling.

- If you receive email or SMS containing a Link to issue the refund of your IT returns, do not open it.

- IT Department or any other financial Institution never asks users their personal information over SMS, Email or Phone Call. If there is a need to communicate, you will receive a written letter on your address of correspondence.

Report to Income Tax Website In case you receive such Phishing emails or SMS.